HARRY'S BI-WEEKLY UPDATE 10.13.15

October 13, 2015

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

INTERNATIONAL relocation CONFERENCE WAS QUITE EDUCATIONAL

As many of you know, I spent last week in Boston attending the semi-annual Worldwide ERC Global Workforce Symposium. Once again, I was the only Residential Realtor from Colorado Springs in attendance. I attend these conferences in order to keep current on all the nuances involved in helping to make relocation as stress-free as possible for my clients.

Meeting with HR Directors of International and U.S. companies and with representatives of actual movers, banks, and other entities who are involved with relocating folks from all over the world as well as simply around the block, helps me provide my clients with the best services available.

I also participate in sessions of the relocation Directors Council (RDC), an organization of which I am a Past President and Life Member. The organization is composed of 250 relocation Directors and Executives, many of who are Certified Relocation Professionals as well as Global Mobility Specialists. We represent 5,000 real estate Offices and 215,000 Sales Associates. This is a network of individuals I’ve known and worked with for many years. I know when I have a client relocating to or from another city I can refer one of my clients to them and they will provide the same kind of excellent customer service that you’ve come to expect from me.

Of course, Boston wasn’t all work and no play. We had a great look at history in our visits, among others, to the John F. Kennedy Library and the Boston Public Library with it’s current exhibit of “We Are One, Mapping America’s Road from Revolution to Independence”.

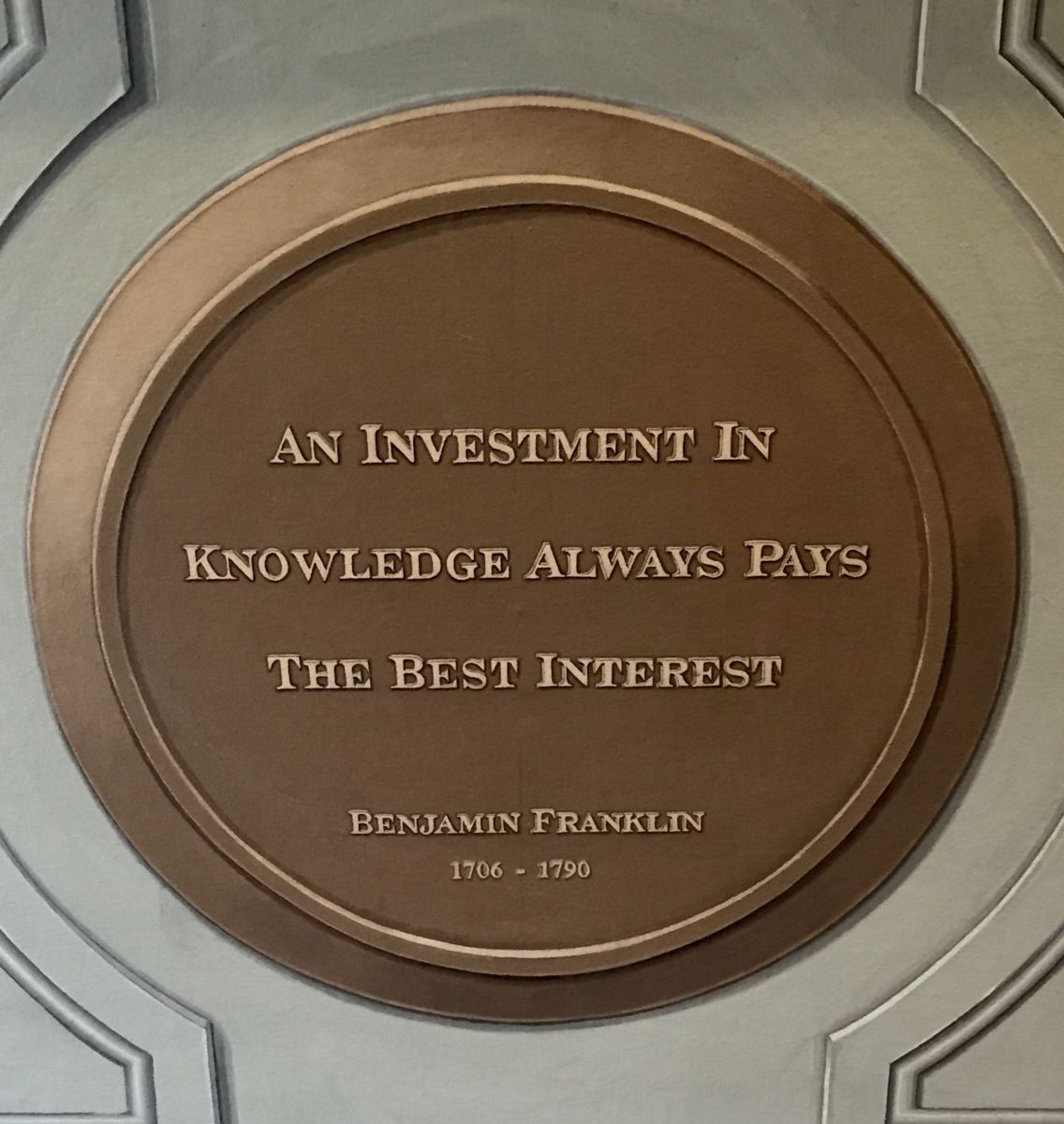

And of course, no trip to Boston would be complete without a walk along “The Freedom Trail”, where the above photo was taken at the Old State House. I couldn’t help but email a copy of it to my friend Vencat Reddy, Dean of the UCCS School of Business, as I knew he’d agree and it most certainly mirrors my personal philosophy.

That’s one of the primary reasons I take the time to publish my eNewsletter—I know that the more my clients understand about what’s happening in the real estate arena, the better prepared they can be when it’s time to buy, sell, trade up or invest.

Having just returned, I will go through the myriad materials I accumulated there and hope to share some of this knowledge with you in the next issue.

SEPTEMBER 2015 IS THE 14TH STRAIGHT MONTH OF INCREASED LOCAL RESIDENTIAL real estate SALES

Statistics provided by the Pikes Peak REALTORS Service Corp, or it’s PPMLS

This is beginning to sound like a broken record—but there we go again! I am happy to report that things are continuing to look excellent for the Pikes Peak Region in the Residential real estate Market.

In the Cumulative Year-To-Date Summary you will see that total sales numbers in Single Family/Patio Homes is up 19.3% over the same period last year. And Condo/Townhome sales are up 33.5% over the same period last year.

You will also see that while total active listings still remain down from the same period last year, new listings in September were up 7.2% in the Single Family/Patio Homes category from the same period last year.

These numbers continue to reflect strong consumer confidence and local job growth, along with low interest rates that many feel won’t be around much longer. More and more folks are taking advantage of increased home equity in order to sell and trade up while getting still historically low interest rates.

Increased new listings mean more choices for those looking to buy. It is still somewhat of a Sellers market, so it’s important to know what you want, need and can afford prior to the hunt for a new home. Making a quick decision can be necessary at times in order to get the home you want.

If you’ve been thinking about using the current equity available in your present home for a down payment on a new home, don’t wait any longer if you want to take advantage of the still low interest rates. “Wait and see” is no longer an option in most cases.

To discover the options available for you, give me a call sooner than later and let’s see what we can do to make this happen. I can be reached at 598.3200 or by email at Harry@HarrySalzman.com.

Here are some highlights from the September 2015 PPAR report. Please click here to view the detailed 13-pages, including charts for September 2015. If you have any questions, as always, just give me a holler.

In comparing September 2015 to September 2014 in PPAR:

Single Family/Patio Homes:

- New Listings are 1,339, Up 7.2%

- Number of Sales are 1,191, Up 16.1%

- Average Sales Price is $267,612, Up 5.7%

- Median Sales Price is $240,000, Up 6.7%

- Total Active Listings are 3,215, Down 16.1%

Condo/Townhomes:

- New Listings are 165, Down 4.1%

- Number of Sales are 183, Up 19.6%

- Average Sales Price is $178,978, Up 10.2%

- Median Sales Price is $160,000, Up 6.7%

- Total Active Listings are 277, Down 31.6%

COLORADO SPRINGS AREA MONTHLY SINGLE FAMILY/PATIO HOME SALES ANALYSIS*

Median Sales Price Average Sales Price

Black Forest $411,250 $409,695

Briargate $293,500 $319,079

Central $193,300 $211,233

East $191,000 $209,223

Fountain Valley: $205,900 $210,987

Manitou Springs: $365,000 $378,957

Marksheffel: $248,000 $253,153

Northeast: $235,000 $252,751

Northgate: $370,500 $413,682

Northwest: $355,000 $354,643

Old Colorado City: $227,500 $245,026

Powers: $225,000 $236,423

Southwest: $270,000 $305,693

Tri-Lakes: $392,500 $428,458

West: $243,000 $320,011

*Statistics provided by the Pikes Peak REALTORS Services Corp,or its PPMLS.

NEW MORTGAGE LOAN DOCUMENTS DESIGNED TO HELP BORROWERS

RealtorMag, 10.2.15, Wall Street Journal, 10.2.15

Mortgage borrowers are now finding it easier to compare different loan products and understand the total cost of their loan under new rules that took effect on October 3, 2015. These changes are part of the Consumer Financial Protection Bureau’s (CFPB) “know before you owe” initiative. They aim to provide consumers with more time to review total costs of their mortgage prior to closing.

Here’s the breakdown of the changes:

Four previous documents are now reduced to two.

- The “Loan Estimate”, provided by the lender at the time of mortgage approval, will replace two of the documents, The Good Faith Estimate and the initial Truth-in-Lending Statement.

- The “Closing Disclosure”, provided by the lender just before closing, will replace the HUD-1 Settlement Statement and the final Truth-in-Lending Statement.

There is no way to even compare the Good Faith Estimate with the new Loan Estimate according to many lenders. The document has changed dramatically, but the changes are now very consumer-friendly.

Consumers can now easily check to see whether the loan amount, interest rate, monthly payment, escrow sum and the amount that a borrower needs to bring to the closing (a new feature) have changed from the lender’s initial estimate. The Loan Estimate also itemizes all closing costs and indicates which services a borrower can shop for, such as the title-search company and pest inspector.

Also included is information to help the borrower better understand the long-term costs of the loan, and shows what a borrower will have paid in principal, interest, mortgage insurance and other loan costs at the five-year mark.

In order to help with comparison-shopping, the Loan Estimate will detail the annual percentage rate (APR) so a borrower can put documents side by side and easily compare overall costs between different loan products such as a 15-year and 30-year mortgage. The APR factors in mortgage-broker fees and closing costs along with the interest rate.

Now also shown is the total loan interest percentage—the total amount of interest that a borrower will pay over the term as a percentage of the loan amount.

The Closing Disclosure also is more consumer-friendly than the documents it replaces and now shows what portion of the payment goes toward homeowner’s insurance, mortgage insurance, interest and taxes.

With the forms much less confusing and more concise, mortgage borrowers are going to get a much better picture of what they will owe at closing and throughout the lifetime of the loan.

There is one rule change that is of concern to some lenders but should not affect most borrowers. That rule mandates three business days for hard copies of the Closing Disclosure to be received by mail and reviewed for any issues or errors by the borrower. If no issues arise, closing can take place three days later. This applies even if the document is hand delivered or electronically sent.

If there are late changes in the loan terms, such as switching from a fixed-rate loan to an adjustable-rate, a new Closing Disclosure form may be required which could delay closing. This could hurt in a highly competitive market where multiple offers and bidding wars with cash offers are possible.

However, the CFPB emphasized that the disclosure form and waiting period were designed to help borrowers pick the best loan option for their individual situation and that this could even take away some stress because borrowers will know a week in advance if they are going to close.

LOCAL CONSTRUCTION PACE CLIMBS

The Gazette, 10.2.15

For the eighth straight month in year-over-year comparison, homebuilders in El Paso County increased the number of permits issued to builders and individuals. The 233 total for September was almost a 30% increase over last September, and brought the year to date total to 2,135—a 14% jump over the same period last year.

Factors for this are similar to those in local existing-home sales—low interest rates, increased consumer confidence and increased equity which allows homeowners to sell and trade up to a new home.

Area statistics are mirroring those across the county, where construction spending in August increased 0.7% to the highest level since May 2008.

RATE INCREASES ARE STILL A POSSIBILITY THIS YEAR

While inflation is remaining flat and the Federal Reserve did not increase interest rates at their September meeting, there are signs that an increase is still possible before the year’s end.

Stock market volatility in the U.S. as well as in foreign markets is thought to be a side effect of those waiting to see what the Fed does in terms of rate increases and there are those that want the Fed to either raise the rates or stop talking about it.

I certainly don’t want to predict what will happen, but at some point we know the rates WILL go up, and with them, the end of historically low mortgage lending rates. Rising rates can make a significant difference in monthly mortgage payments so if you’ve been even considering whether it’s the time to make a move—it’s worth checking it out soon.

A word to the wise can never hurt!

HARRY’S PHILOSOPHY OF THE DAY

Two real estate agents decided to start a new career to sell shoes. The agents go to Africa to open up new markets.

Three days after arriving, one real estate agent said, "I’m returning on the next flight. Can’t sell shoes here. Everybody goes barefoot."

At the same time the other real estate agent sent an email to the factory saying, "The prospects are unlimited. Nobody wears shoes here!"

Guess which agent I am? Happy Wednesday.

FEATURED LISTING