HARRY'S WEEKLY UPDATE

|

November 12, 2012

HARRY’S WEEKLY UPDATE A Current Look at the Colorado Springs Residential real estate Market

ON VETERANS DAY….LET US ALL BE THANKFUL

I would be remiss if I didn’t start by paying my respects to Veterans and those currently in the military. Living in Colorado Springs among a big military presence, I am reminded every day of the debt we all owe to the men and women who have served and continue to serve our Country.

So, while I am aware of this on a daily basis, Veterans Day gives me the opportunity to publically say again….Thank You.

3RD QUARTER METRO AREA STATISTICS SHOW STRONG INCREASES, SALES UP

The just published “Median Sales Price of Existing Single-Family Homes for Metropolitan Areas” from the National Association of Realtors (NAR) has great news all around. As always, we track comparison of the Colorado Springs metropolitan area against the other 148 metro areas in the survey. This information is so important that many other publications provide their take on it. I will share some of that in a minute. This most important hightlights are:

Lawrence Yun, NAR chief economist has said the growth in home prices gets down to supply and demand. “Housing inventories have been gradually trending down from a record set in the summer of 2007, and earlier this year a broad equilibrium began to develop in most areas between the home buyers and sellers, which led to a sustained upturn in home prices. We expect fairly normal appreciation patterns in 2013, but there is a risk of price acceleration if builders are unable to increase supply to meet the needs of our growing population and household formation.”

Nationally, the median exisiting single-family home price was $186,100—up 7.6% from $173,000 a year ago. This is the strongest year-over-year increase since first quarter 2006 when the median price rose 9.4%.

NAR President Moe Veissi of Miami said affordability conditions are a big factor in rising sales. “Historically low mortgage interest rates are encouraging many buyers who were on the sidelines,” he said. “Sales this year are notably higher than the levels seen in 2008 through 2011, so we’re clearly in a recovery phase with rising sales, declining inventory and rising prices. Of course, the recovery would be stronger and more stable if we could return to safe but sensible mortgage underwriting standards.”

The Wall Street Journal wrote last Thursday that this survey is the “latest evidence that the real-estate recovery is gaining momentum and breadth…All told, low home prices, rising rents and a slowly improving economy have given more Americans the motivation and confidence to become homeowners. About 72% of respondents said it was a good time to buy a home, according to a monthly survey Fannie Mae issued Wednesday.” They went on to say that “while many consumers expect home prices to rise only modestly over the next year, they believe rental rates will continue to climb, further motivating them to buy.”

Click here to view the survey in its entirety.

Now about Colorado Springs…..as I’ve told you in the past, our Metro area has never been among the highest appreciating cities, nor one of the cities that was considered “upside down negative” during my 40 years in this business.

Locally, the long term appreciation has been almost 6.0% per year. The current median sales price of existing single-family homes for Colorado Springs is 6.4% compared to a year ago, a percentage derived through all MLS sales during that 12 month period in our area. Our median price is now $206,100, up from $193,700 at the end of 3rd quarter last year.

A good reason that the national median price gain is above our local one is that most metro areas in the survey had a much lower price drop in the past few years than we did. Therefore, the gain we see from our traditional one is a good sign that we are doing better than normal in single-family sales.

Again, folks, look at the trend and remember what I’ve been telling you….there is no better time than now if you are in the market for a single family home, whether to live in or for investment purposes. Call me at 598.3200 and let’s talk about your options before prices and interest rates start climbing higher.

HERE’S A BRAND NEW JUSTIFICATION TO BUY A HOME TODAY

We don’t believe you’ve heard this one yet, but The Wall Street Journal has been writing that:

The Dow Jones U.S. Home construction Index is up 80.3% as of October 26, 2012 from January 1, 2012. The Standard and Poor over the same time of almost ten months increased 12.3%. Therefore, shares of public companies in the home building industry performed higher than 500 companies in S&P by almost 7 times better in 2012.

Since public investors are stating loudly that “Now is the Time” that more buyers are purchasing a home, heed their advice (and ours) and take a closer look at today’s real estate market from your personal perspective.

Call us to compare your options of buying a home today vs. other investments you could make (i.e. mutual funds, stocks, bonds, etc.). As always, we suggest you check with your personal accountant in addition to talking with us.

RESIDENTIAL real estate SEEN AS A GREAT WAY TO BUILD WEALTH

In the past week, NAR has published several articles explaining why Residential real estate is again in the forefront of buyers minds when they consider funding their retirement. A number of first time investors are looking at their purchases an a supplement to their present income while considering the possibility of increased value at the point when prices rise high enough for them to sell.

Reasons include:

We’ve been telling you much of this over the past year and for good reason—we don’t want you to miss out on a great opportunity to invest while the market is hot. These opportunities won’t be around forever and if you’ve been thinking about investing, the time is NOW.

WE’RE HERE TO SERVE ALL YOUR real estate NEEDS

Whether you’re considering buying, selling, investing or simply need help in making an informed decision about what fits your individual housing or investment needs, we’re here to help. Just give us a call at 598.3200 or 800.677.MOVE (6683) today.

And if you have a friend, family member or co-worker who wishes to buy or sell local real estate, or who is planning a move to the Pikes Peak region, remember—I’ve got more than 40 years of experience in providing relocation and Real Estate services to clients throughout the world. I am uniquely qualified to assist them in making the best decision for their individual wants and needs and always take that into consideration when negotiating on their behalf. Have them contact me at Harry@HarrySalzman.com and I will be happy to add them to our eNewsletter list, or better still, send me a note with their email address and I will take care of it right away.

JOKE OF THE WEEK

I have been in many places, but I’ve never been in Cahoots. Apparently, you can’t go alone. You have to be in Cahoots with someone.

I’ve also never been in Cognito. I hear no one recognizes you there.

I have however, been in Sane. They don’t have an airport; you have to be driven there. I have made several trips there, thanks to my friends, family and work.

I would like to go to Conclusions, but you have to jump, and I’m not too much on physical activity anymore.

I have also been in Doubt. That is a sad place to go, and I try not to visit there too often.

I’ve been in Flexible, but only when it was very important to stand firm.

Sometimes I’m in Capable, and I go there more often as I’m getting older.

One of my favorite places to be is in Suspense. It really gets the adrenalin flowing and pumps up the old heart. At my age I need all the stimuli I can get.

And, sometimes I think I am in Vincible but life shows me I am not!

FEATURED LISTING

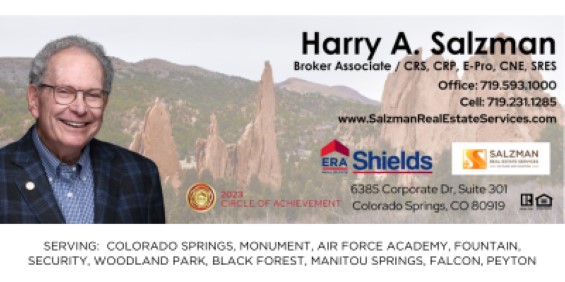

Harry A. Salzman. CRS, CRP, CNE email: Harry@HarrySalzman.com

Serving: Colorado Springs, Monument. Air Force Academy, Fountain,

|